Visa Intelligent Commerce: Technical Architecture & Security for Autonomous AI Payments

Date: February 2026 Target Audience: Technical analysts, fintech architects, product leaders

Executive Summary

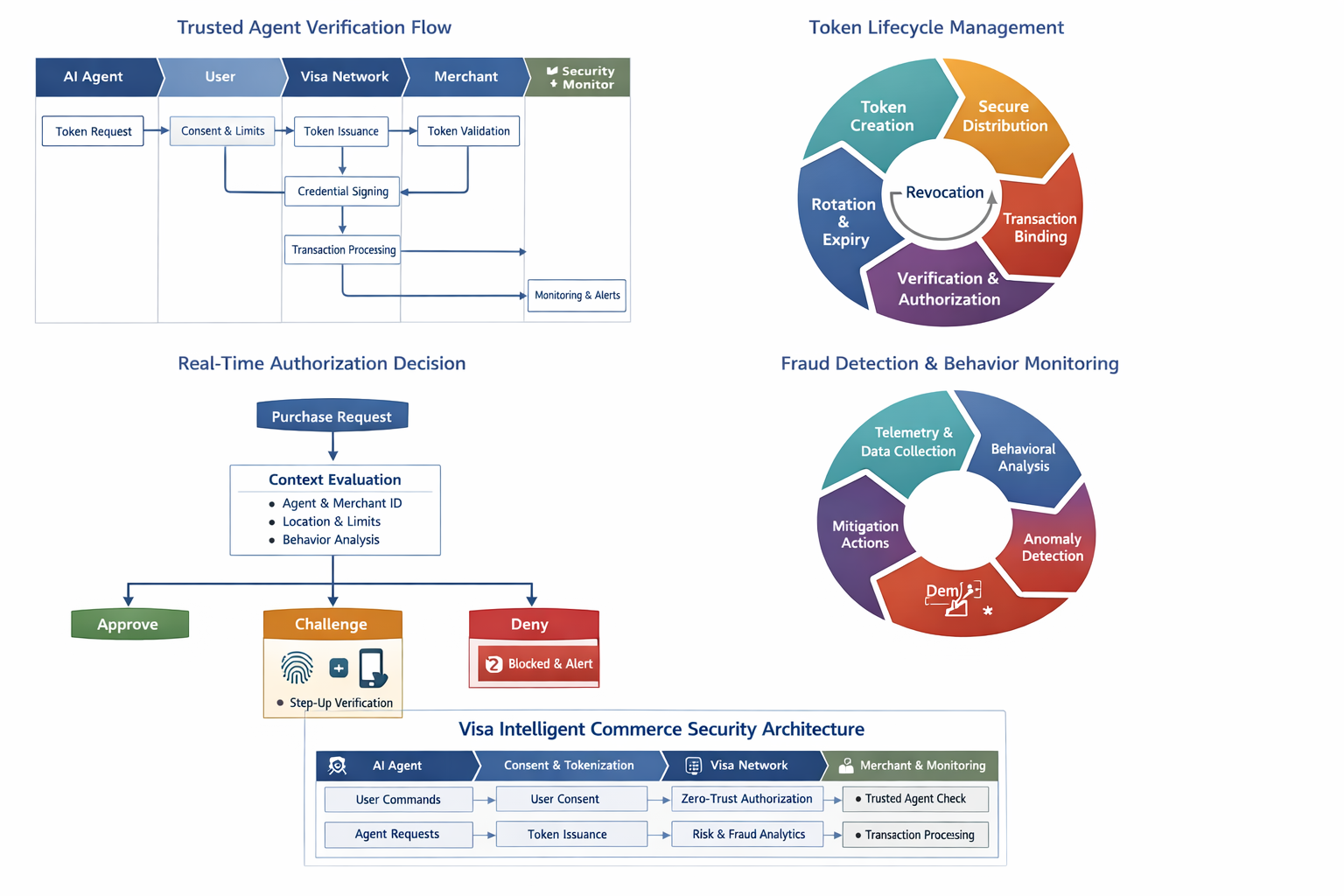

Visa Intelligent Commerce (VIC) represents a major evolution in digital payments, enabling AI agents to transact autonomously on behalf of users within secure, transparent, and consent‑driven frameworks. Leveraging advanced tokenization, agent‑specific credentials, real‑time authentication, and a new Trusted Agent Protocol, VIC integrates AI‑centric commerce into Visa’s global network. Early pilots and ecosystem partnerships demonstrate real‑world viability across retail, travel, and financial services. With a comprehensive security layer and developer tooling such as model context integration and API toolkits, VIC aims to define the future of personalized, intelligent commerce. (Visa)

1. Introduction & Background

AI‑driven assistants are transforming online activity, from product discovery to personalized recommendation. However, traditional payment systems still require human input for final purchase authorization. Visa Intelligent Commerce bridges this gap by empowering AI agents to complete secure, authorized transactions on behalf of users while preserving user control, privacy, and merchant trust. (Visa)

Visa has long provided secure, tokenized payment rails; VIC extends this infrastructure to agentic workflows — interactions where an autonomous system acts with consent and within defined parameters. Surge in AI‑generated ecommerce traffic has prompted this innovation, with merchants and partners preparing for large scale agent adoption. (Visa)

2. Key Objectives

The report addresses:

- Technical foundations enabling agentic payments through VIC.

- APIs and integration points for developers.

- Security mechanisms protecting agents, users, and merchants.

- Operational workflows including authentication, token lifecycle, and transaction signals.

- Developer tooling and extensibility for real‑world deployment.

- Future outlook and recommended best practices.

3. Technical Architecture

3.1 Agent‑Ready Credentials & Tokenization

Central to VIC is the use of agent‑specific, tokenized credentials that represent a user’s payment source (e.g., card) in a secure, bounded context. Visa’s Token Service provisions dynamic tokens linked to:

- Agent identity

- User consent parameters

- Merchant contexts

- Spending limits

These tokens never expose PAN (Primary Account Number) to agents or merchant systems, significantly reducing sensitive data exposure. (Visa)

APIs enable:

- Provisioning and lifecycle management of tokens

- Step‑up authentication linked to user intent

- Token revocation when limits are reached or consent is withdrawn

This architecture mirrors modern tokenization best practices, where a unique identifier replaces sensitive credentials in all transaction stages.

3.2 Authentication & Consent Frameworks

Visa builds on its established authentication stack (including biometric options, step‑up challenges, and continuous risk scoring) and binds these to agent actions using secure contexts known as payment instructions. These instructions contain:

- User’s explicit intent (e.g., “purchase item X under $Y”)

- Time windows, merchant restrictions

- User authentication status (biometric/passkey confirmation)

Agents retrieve credentials within this bound context, ensuring authorization adheres strictly to the user’s defined scope. Modern identity standards, like Visa Payment Passkey and secure APIs, streamline biometric authentication per user action. (Visa)

3.3 Trusted Agent Protocol

To support agentic commerce, Visa introduced a Trusted Agent Protocol — an open, ecosystem‑led specification enabling merchants to verify AI agents’ identity and intent before honoring transactions. It:

- Uses cryptographic signatures tied to agent identity

- Provides real‑time signals that distinguish legitimate agents from malicious bots

- Embeds ownership and intent metadata (who the agent represents and what it is authorized to do)

Merchants integrating this protocol can trust agent‑generated traffic and checkout flows without significant infrastructure changes. (Visa Corporate)

Enterprise integrations: Partner solutions like Akamai’s behavioral intelligence layer enhance agent verification at edges, blending protocol signals with real‑time risk assessment and bot detection. (investor.visa.com)

3.4 Developer Tooling: APIs & Integration Stack

Visa offers a structured API suite to power agentic commerce:

-

Tokenization & Authentication APIs

- Provision and manage agent‑specific tokens

- Integrate biometric authentication and passkey flows

-

Payment Instructions & Signals APIs

- Enroll tokens into the VIC platform

- Submit and update user purchase instructions

- Retrieve credentials for merchant checkout

- Receive transaction outcome and event notifications

-

Personalization APIs

- Retrieve user‑specific spend insights

- Support intelligent recommendation logic tied to profiles

-

Model Context Protocol (MCP) Server

- Acts as a secure intermediary between Visa’s core services and AI agent frameworks

- Simplifies secure API access for agents and developers

- Supports rapid integration without bespoke backend engineering

These APIs allow agents to seamlessly integrate in workflows, from product discovery to final settlement, while maintaining user trust and consent governance.

4. Security & Risk Mitigation Analysis

Visa’s security model for VIC layers traditional payment protections with agent‑aware contextual safeguards to balance convenience with risk reduction.

4.1 Multi‑Layer Token Security

Tokenization protects privileged credentials and binds tokens to specific agent contexts, enabling multiple safeguards:

- Scope enforcement: Tokens are valid only within defined merchant and time boundaries.

- Revocation: Tokens can be cancelled instantly on suspicious behavior or loss of consent.

- Isolation: Compromised tokens do not expose real card data or credential pools. (Visa)

4.2 Zero‑Trust Runtime Verification

Research into agentic payment protocols highlights the need for runtime context binding to prevent replay or misuse of credentials. In a zero‑trust model, each execution context is verified using dynamically generated, short‑lived nonces and explicit mandate signatures, eliminating assumptions about token validity beyond issuance. (arXiv)

4.3 Trusted Agent Identity & Behavioral Verification

Authentication alone isn’t sufficient — Visa’s integration with edge intelligence partners enables:

- Real‑time behavior profiling

- Bot vs agent differentiation

- Linkage of agent actions to user identity context before checkout

This closes gaps that arise when autonomous agents operate at scale and helps distinguish credentialed agents from malicious automation. (investor.visa.com)

4.4 Enhanced Controls & Consumer Trust

User consent is central to security. Visa’s consent framework includes:

- Explicit purchase scopes

- Spending limits

- Merchant restrictions

- Conditional rules (e.g., price thresholds)

Real‑time dashboards and logs give consumers visibility and revocation capabilities to control agent expenditures. (Visa)

5. Operational Use Cases

Visa Intelligent Commerce aims to support a wide range of intelligent commerce workflows:

- Travel planning agents that book flights, hotels, and activities with secure settlements. (visa.com)

- Retail shopping agents autonomously applying promotions and loyalty points at checkout. (Visa Corporate)

- Inventory management bots in B2B settings that reorder supplies upon threshold events. (visa.com)

- Smart home commerce that automatically purchases essentials based on predefined rules. (Visa)

Each use case leverages tokenized credentials, trusted agent protocols, authentication APIs, and consent frameworks to ensure transactions are both secure and aligned with user preferences.

6. Ecosystem & Adoption

Visa is collaborating with global banks such as DBS Bank to pilot agentic commerce for everyday payments. These real‑world tests validate credential issuance, transaction controls, and authentication flows at scale. (Visa)

Partnerships with AWS, Anthropic, OpenAI, Microsoft, and others aim to standardize agent integration and developer workflows, including model context bridging and secure connectivity. (US Press Center)

Beyond Visa’s own ecosystem, the Trusted Agent Protocol is designed as an open standard for wider merchant and platform adoption. (Visa Corporate)

7. Discussion & Implications

Benefits:

- Reduced checkout friction

- Highly personalized and anticipatory commerce

- Lower cart abandonment

- Enhanced merchant conversion

Technical Challenges:

- Managing runtime security context at AI scale

- Standardizing agent identities across ecosystems

- Ensuring fraud detection keeps pace with intelligent automation

Regulatory Considerations:

- Liability frameworks when autonomous agents err

- Privacy and data residency regulations

8. Recommendations

- Adopt standards like the Trusted Agent Protocol early.

- Use zero‑trust verification for runtime authorization.

- Integrate robust consent and revocation dashboards.

- Combine protocol signals with behavioral intelligence for fraud detection.

References

See the version above for full clickable references; main sources include Visa product pages, developer docs, and ecosystem press releases. (Visa)